Partner with a financial guide who grows and adapts based on you.

✔️ Get answers to your financial questions.

✔️ Organize your money in minutes.

✔️ Access a Certified Financial Planner™ to help you through whatever life throws your way.

Spend less time worrying about money, and more time living a fulfilled life.

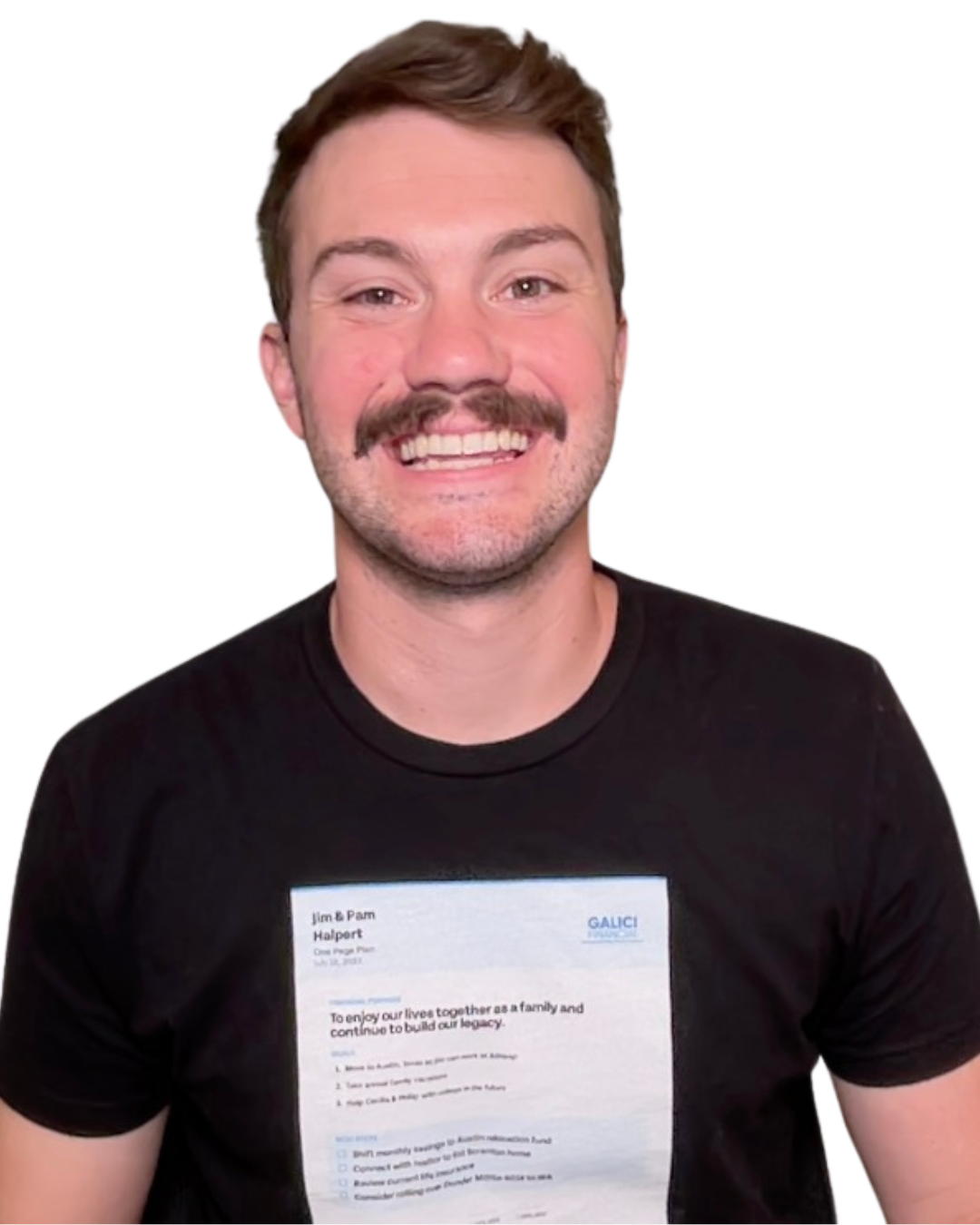

Brandon Galici, CFP®

Founder/Financial Planner of Galici Financial

Featured In

Your financial questions answered.

How are you doing financially? What actionable steps can you take to feel more confident and secure with your money?

We answer these questions and more. By exploring together why money is important to you and understanding your current financial situation, you then receive tailored actionable insights to accomplish your desires so you feel more organized and in control of your financial life on an ongoing basis.

Financial organization

at your fingertips

Receive invitation-only access to the user-friendly Elements® Financial Monitoring app that helps you access ongoing financial advice where you receive quarterly progress reports to ensure you are heading in the right direction.

How We Work Together

-

Private Financial Planning and Consulting

Get personalized financial guidance that aligns with your values. You receive full access to one-on-one strategy sessions, monthly reports, tailored next steps, and proactive insights about your money. Portfolio management services are also available. Typically best for households with incomes of $150k per year+ or investable assets of $150k+.

-

Millennial Money Membership™

Get financial coaching and exclusive access to the powerful Elements® app to organize your financial life, answer your financial questions, and take the next step with your money. Gain clarity, confidence, and alignment with your core values to lead a fulfilling life. Typically best for households with incomes of less than $125k per year.

I created Galici Financial to do financial planning differently. The financial services industry primarily focuses on product sales and investment returns instead of what truly matters most: YOU.

Before we get into the nitty-gritty details of all of the numbers that are important to planning, I want to learn more about you. What matters most to you? How fulfilled are you in your everyday life? What are you most passionate about? What does living a joyful life look like to you? Once we have our foundation on what maximizing your life today while planning for the future looks like, we then dive deeper into the financial planning process. At that point, I'll learn more about your unique situation and recommend strategies and solutions to help you develop a personal financial plan and take action.

Investment Philosophy

Imagine you’re planning to take a trip.

The first option seems fast, like you’re going to get there in no time. But halfway into the trip, you realize that you’re heading the wrong direction!

You make it to your destination, but not without a lot of stress and frustration along the way.

The second option doesn’t seem too fast or too slow, but a nice steady pace. You have a great route planned from the beginning, and are able to adjust and alter as needed. You make it to your destination feeling refreshed.

Assuming your total travel time is the same for both options, which would you prefer?

Our investment philosophy is to minimize your downside losses (major wrong turns), so that you can feel more secure and confident in your investment journey. We want to “smooth out the roller coaster ride," compared to barreling down the freeway at high speeds only to realize we’re going the wrong way (bigger losses).

CONTACT US

© 2024 Galici Financial

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. Galici Financial is a financial coaching firm and licensed insurance agency which is separate from its role as an investment advisor representative of Portfolio Medics, LLC. Investment advisory services are offered through Portfolio Medics, LLC. Galici Financial and Portfolio Medics, LLC are not affiliated. The information contained on this site is intended for educational purposes only. It does not constitute financial planning/investment advice, nor is it a substitute for financial planning/investment advice. Nothing in this message should be construed as financial planning/investment advice.

*quote from https://www.portfoliomedics.com/about/